After Sears’ bankruptcy questions abound as to the viability of the commercial real estate landscape. Many investors are wondering, has the digital age made “Big Box” brick and mortar shopping obsolete? The answer is a resounding no. Sears, Toys R Us and similar large-box, one-stop shopping stores are more compass than a canary in the coal mine.

Instead of jumping to the conclusion that digital shopping is replacing in-person shopping, consider the critical variables that have emerged. First, stores like Sears and Toys R Us were not nimble or agile enough to navigate the fast-paced changes of the current retail market. These stores were burdened by what was once their asset: their size. Trying to be everything to everyone put them in the market where they were neither specialized nor cost-effective.

Their broad product line made competing with specialized competitors impossible and the cost of their large real estate footprints made it difficult to compete, even with their scale, with lower prices. This model might signal that JC Penny may be next, but that is the farthest the conclusion should be taken. Even stores like Macy’s and Kohls have more adaptable models that can fit into smaller shopping centers, whereas Sears and JC Penny would not.

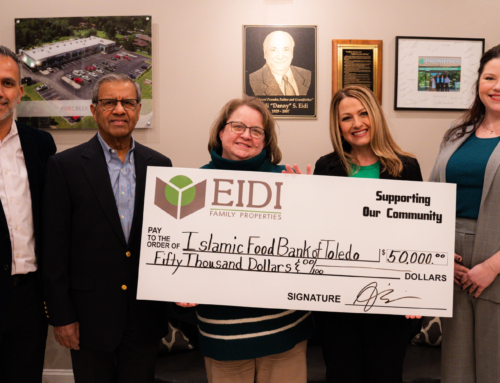

This is where the advantage of versatile shopping centers, like the predominant holdings of Eidi Properties, makes more and more sense in today’s shopping reality. A shopping center maintains low overhead due to the relatively constrained real estate footprint and allows the various merchants to provide the specialization and cost-effective merchandise to local shoppers. Instead of trying to create a one-size-fits-all store, these centers provide store ownership from the local community who are tapped into their consumer needs. In turn, local retailers and neighborhood shopping centers are finding ways to work with e-commerce through various channels like eBay, Etsy and Amazon, in order to reach broader markets and maintain price points that will keep them competitive across the board. The commercial real estate landscape appears to be veering from the do-everything stores to providing the facilities that allow a dynamic and adjustable clientele to occupy the spaces that best provide for local shoppers.

These shopping centers are also, inadvertently, part of a solution to an ever-growing problem in America— parking. Parking our cars takes up a lot of space and land is becoming so expensive, particularly in the cities, that parking has become a cost-benefit nightmare. In the conventional mall, where stores like Sears and JC Penny are located, the mall takes up a huge amount of space, surrounded by a parking lot that also consumes acres and acres. People park then walk to the mall where they walk inside the mall.

This use of space is inefficient and expensive, which is hard to justify in a competitive economy where every dollar counts. This is also why smaller impact shopping centers, like Eidi Properties, can thrive. Their stores don’t require enormous spaces or expansive parking lots to be sufficient. Most consumers can pull up near the store they are targeting and get in and out easily, which is convenient for consumers and more cost-effective for merchants.

Physical shopping is not being replaced by digital. In fact, companies like Amazon and Warby Parker are migrating from digital to physical. The physical commercial real estate must be responsive to the new realities, however. Ultimately, the modern commercial real estate needs to adapt to the modern consumerism and economic reality. The one-stop-shop was great when people were driving their tractors to town to sell their produce. The modern world has abundant, diverse and distributed consumer options. Therefore, companies like Sears and JC Penny have few advantages to compete in the marketplace where shopping centers, like the ones at Eidi Properties, are thriving.

This story was written by Jerry Mooney.