Last week we wrote a piece on the criteria Eidi Properties use to determine the viability of a potential property. Location, location, location were the three rules discussed. There are other factors, however, beyond the big three, notably, cap rate and occupancy. Although cap rate and occupancy can fall under the three rules, here is how they are distinct and important to our evaluations.

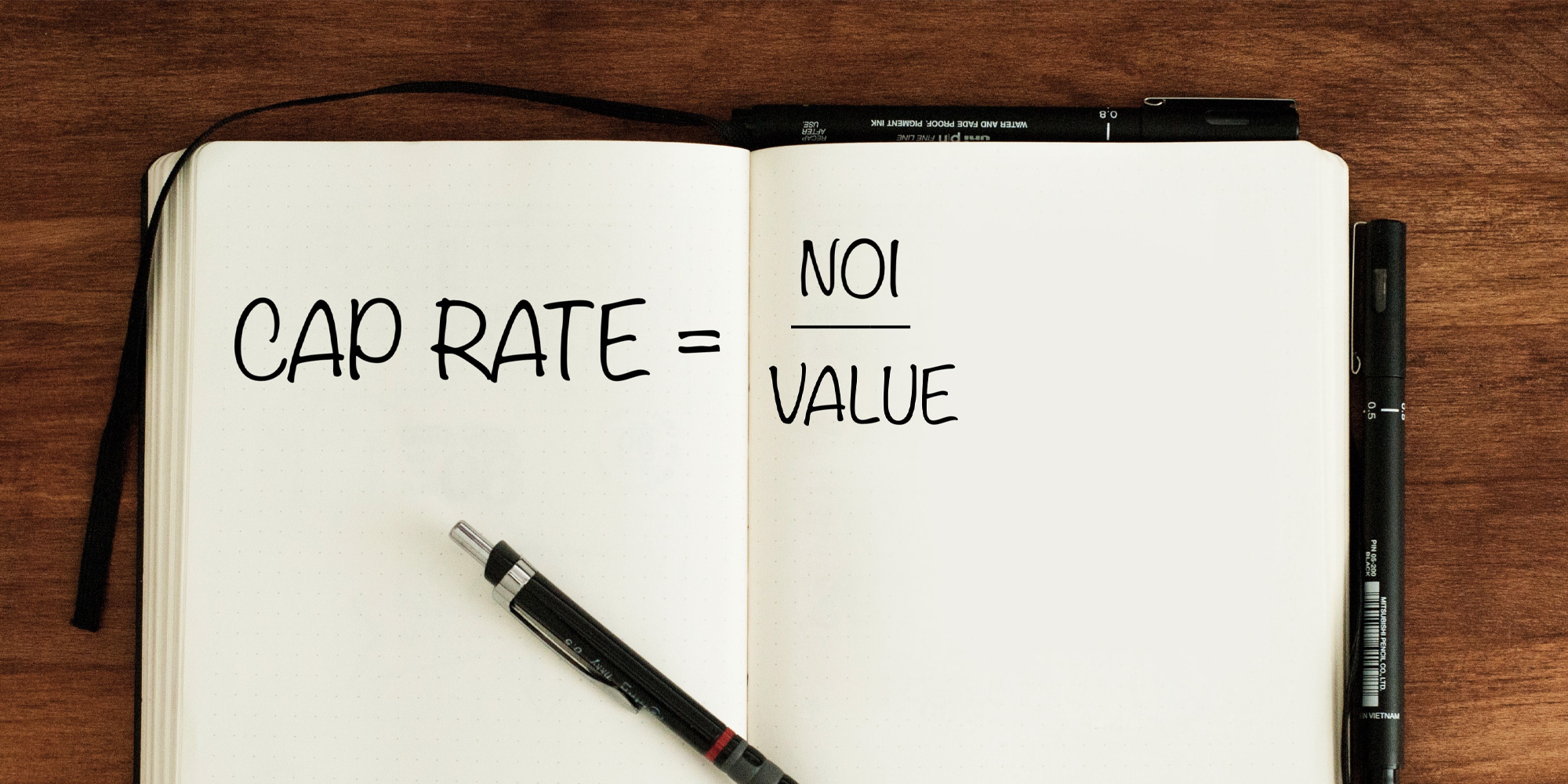

Cap rate is shorthand for capitalization rate and means the yield of a property over a year (NET OPERATING INCOME), considering the cash purchase and no debt. This allows us to establish whether or not the location is a good investment. Outside of location, cap rate is the most popular measure through which commercial real estate profitability and return potential is measured. We determine the cap rate by dividing the net operating income (cap rates do not factor in mortgage payment/debt service) by the properties purchase price.

Net is an important word in this equation. Gross income tells the total revenue of the property, but ignores the expenses. Net income subtracts the expenses, and allows us to project the value of the investment. With the cap rate, we can determine what is the ROI (return on investment) and what is the time frame under constant and predictable variable conditions. This also helps us determine the budget for capital improvements, tenant allowances etc., and what a possible future resale value might be.

Simultaneously, occupancy helps us calculate the cap rate. If the property is primarily empty, the entire cap rate is speculative. We prefer properties that are occupied with no more than 25-percent vacancy. The vacancy, at 25 percent, is an area of undeveloped potential, but not a liability as there is still 75 percent or more occupied stores. There is a ratio of risk to reward that is also considered. If a cap rate is high, the risk is higher, but potentially so is the reward. This puts us in a situation where we must evaluate the CBA (cost-benefit analysis) and consider our risk tolerance.

Yes, location, location, location are still the three primary rules of commercial real estate investment. Both those rules have nuance and detail that must be considered. Cap rate and occupancy are part of the rules, but they are also their own, significant criteria for our investment considerations. We take these rules seriously in order to maintain our best business practices and create the conditions for success, now and into the future.